Every April, many Americans have to hustle to make sure the taxes they owe the IRS are paid. While most businesses take pains to ensure they have no unpaid taxes, certain events may make it more difficult to prioritize these payments. For example, financial hardship can force a business owner to prioritize paying vendors and employees over paying the federal government. Unfortunately, this will eventually have serious consequences. In today’s post, we’ll talk about the potential repercussions of owing taxes and the recommended next steps business owners in this predicament should take.

Every April, many Americans have to hustle to make sure the taxes they owe the IRS are paid. While most businesses take pains to ensure they have no unpaid taxes, certain events may make it more difficult to prioritize these payments. For example, financial hardship can force a business owner to prioritize paying vendors and employees over paying the federal government. Unfortunately, this will eventually have serious consequences. In today’s post, we’ll talk about the potential repercussions of owing taxes and the recommended next steps business owners in this predicament should take.

What might happen if my business has overdue taxes?

There can be many possible effects of not paying the taxes one owes. When you fail to file your taxes and make payments owed, you’ll first receive a notice from the IRS informing you of such. Be advised that you will receive written notices via mail only. If you do not address these notices, the IRS will assign a local agent to your account, who will make visits to your business to resolve these issues. When a business does not cooperate, the IRS can seize their financial assets (e.g., customer payments, funds in accounts) and/or put a lien on the business. This can affect a business’s credit rating and can even force the business to close.

In addition, the back taxes you owe will cause the IRS to hold any entitled tax refunds until these unpaid taxes are rectified. These unpaid taxes also come with their own penalties and interest fees, making the amount you owe even higher. It’ll be much more difficult for your business to obtain financing or loans in these cases. And if you’re self-employed, the amount you earn during this time won’t even be reported to Social Security, which will impact your retirement savings. And while it’s rare, the IRS can even file criminal charges against you if they suspect tax evasion. Simply put, not filing the taxes your business owes can have huge ramifications for your future.

What should my business do if we owe back taxes?

You should first be aware that the IRS can collect back taxes owed for up to 10 years — so the problems that stem from a failure to make these payments won’t go away any time soon. This is why it’s so important to be proactive if you do find you need help with your taxes.

While facing the music can be scary, it won’t help to try to hide from it. This will just make matters worse. You should first enlist the help of a professional accountant or tax preparer to have a better idea of what you owe and how to prioritize these payments. You may also need to adjust vendor or supplier payments, if at all possible. Most importantly, you’ll need to respond to the IRS notice(s) you receive quickly and show them you are more than willing to cooperate in any way you can. You’ll likely have more options to clear up your owed taxes than you might have assumed, but any delays you make will not help you in this regard, either. The only way to turn things around is to address them head-on with help from a knowledgeable tax defender.

If your organization owes back taxes, you don’t need to panic — but you do need to take action. To find out more about how we can help, please contact us straight away.

With so many inflammatory headlines dominating today’s news cycle, it’s all too easy to panic about bills being passed and what they mean for your family. The recently passed Republican tax act is an issue that has many people worked up, as there are points within this tax act that could impact your tax bracket, for example. There’s also a lot we might not yet know about how the tax act might affect you. In fact, even the IRS doesn’t entirely know how the new system will affect you. The IRS estimates it will need

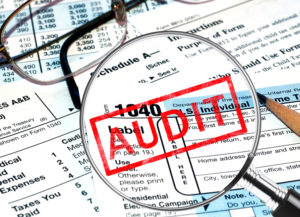

With so many inflammatory headlines dominating today’s news cycle, it’s all too easy to panic about bills being passed and what they mean for your family. The recently passed Republican tax act is an issue that has many people worked up, as there are points within this tax act that could impact your tax bracket, for example. There’s also a lot we might not yet know about how the tax act might affect you. In fact, even the IRS doesn’t entirely know how the new system will affect you. The IRS estimates it will need  If your business owes taxes to the government and is facing an audit, it is natural to be stressed. A tax audit is no picnic, especially if you have unpaid taxes. The best thing you can do is be prepared. There are three different types of audit the IRS will carry out.

If your business owes taxes to the government and is facing an audit, it is natural to be stressed. A tax audit is no picnic, especially if you have unpaid taxes. The best thing you can do is be prepared. There are three different types of audit the IRS will carry out. For many people, filing taxes is an easy thing. However, taxes aren’t always that a walk in the park. In fact, business owners and wealthy individuals can easily run into problems if they’re not careful. This is where tax defenders can come in to help — if for any reason you are in trouble with the Internal Revenue Service, they can assist you in from getting too entangled in the law.

For many people, filing taxes is an easy thing. However, taxes aren’t always that a walk in the park. In fact, business owners and wealthy individuals can easily run into problems if they’re not careful. This is where tax defenders can come in to help — if for any reason you are in trouble with the Internal Revenue Service, they can assist you in from getting too entangled in the law.